Manage Chart of Accounts Structure and Instance

Scenario

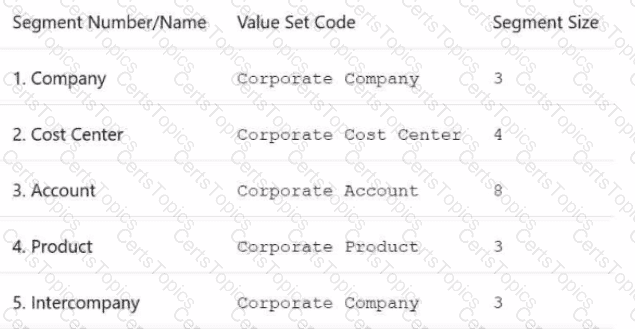

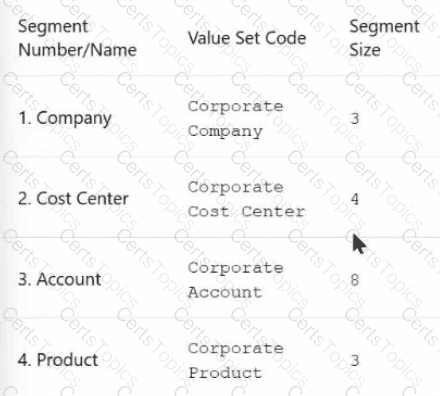

Your client is implementing Oracle Fusion Cloud Financials. The decision is to have a 5-segment Chart of Accounts: Company, Cost Center, Account, Product, and Intercompany. You are working in

the General Ledger team and will be responsible for creating the Chart of Accounts Structure and Instance for the Chart of Accounts.

Task 1

Create a Chart of Accounts Structure and Instance for the following Chart of Accounts:

Note:

· Prefix all your setups with 07, where 07 is your candidate ID

· There is one balancing segment.

· Choose the appropriate segment labels.

. For the purpose of this test there is no need to deploy the flexfield.

. Valid code combinations should be added to the Code Combination table automatically.

· Shorthand aliases will not be implemented.

. Accept the defaults for the instance segments.

Challenge 2

Manage Shorthand Aliases

Scenario

Your client intends to utilize the Shorthand Alias feature and would like to see how the aliases will appear when entering transactions.

Task 2

Create a shorthand alias for the US Chart of Accounts to record Revenue Domestic for Supremo Fitness, Line of Business 2, and US Operations Cost Center.

Note:

. Prefix your alias name with 07, where 07 is

your exam ID.

. There is no Product or Intercompany

impact.

Task 3

Manage Chart of Accounts Mappings

Scenario

Your client needs to consolidate their UK Ledger to the Canadian parent ledger. Each Chart of Accounts

has the following segments:

Company-LoB-Account-Cost Center-Product-Intercompany

Know that the Company, LoB, Product, and Intercompany segments share the same value sets.

Create a Chart of Accounts mappings to map UK Chart of Accounts to CA Chart of Accounts that meets the following specifications:

Cost Center Mapping

. Balance Sheet (0 and 000) should be mapped to

Balance Sheet

. All other cost centers should be mapped to 610

Account Mapping

. Asset accounts (in the 1000 range) should be

mapped to account 11101

. Liability accounts (in the 2000 range) should be

mapped to account 22100

. Equity accounts (in the 3000 range) should be

mapped to account 34000

. Revenue accounts (in the 4000 range) should be

mapped to account 42000

. Expense accounts (from 5000 onwards) should be

mapped to account 51100

Note:

· Do not use conditions based on parents.

. Treat any account after the 5000 range as an expense.

· Ensure all maps are numeric only.

· When creating your mapping rules for each segment

please allow for existing and future segment values

For translation purposes, the Financials reporting team has decided to load the monthly Historical currency rates by using File-Based Data Interface (FBDI).

What happens to the existing historical rate for a specific ledger, currency, account combination, and accounting period if they use insert in the spreadsheet?

You are implementing amultipillarimplementation of bothHCM CloudandERP Cloud. You are implementingERP first, followed byHCM Cloud. You want to ensure yourledgers and chart of accountsare correctly defined.

What should you do? (Choose three.)

Which two are predefined roles in General Ledger?

You are setting up Close Monitor for your organization. What is the key consideration when selecting the ledgers or ledger sets that form part of the Close Monitor hierarchy?

You have set up asupporting reference with balancesto capturerevenue by account manager.

Which option should you use to view thesupporting reference balances?

The intercompany accountants on the cloud project are trying to reconcile intercompany balances using the latest intercompany reconciliation report.

However, they have some concerns about the information presented in the report and want you to clarify the content in the standard reconciliation report.

What is included in the intercompany reconciliation report?

Which two statements are true regarding the Intercompany Reconciliation Report? (Choose two.)

You entered across-validation ruleto prevent thebalance sheet cost center (000)from being used withProfit and Loss Accounts (4000-ZZZZ).

The following combinations exist in theCode Combination table:

01-000-4110-00

01-000-5299-000

01-000-5105-000

01-000-7640-00

Which two statements aretrueregardingcross-validation rules?

InFinancial Cloud, which three reporting tools can be used to accessGeneral Ledger balances?

Your company hascomplex consolidation requirementswithmultiple general ledger instances. You are usingOracle Hyperion Financial Managementto consolidate the disparateGeneral Ledgers.

You can typically map segments between yourgeneral ledger segmentto aHyperion Financial Management segment, such as:

Company to Entity

Department to Department

Account to Account

What happens to segments in yoursource general ledger, such asProgram, thatcannot be mappedtoHyperion Financial Management?

You create a Trial Balance type report using Smart View. As you include all segments for the Chart of Accounts, you expect to see zero balance. Further with the Zoom Out function, you expect to see the balances in each account.

Instead, IMTSSTNG is appearing in the report output.

What is the issue with this report?

What are two uses of theColumn FlatteningandRow Flatteningfeatures?

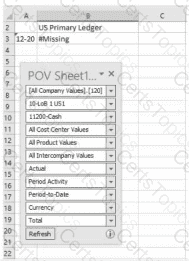

You want to create an Ad Hoc Analysis in Smart View; you enter the following dimensions for the report and click Refresh in the POV.

You get #Missing instead of a balance. What value did you not specify, which resulted in this?

The current implementation project covers Financials (with Fixed Assets and Expenses) with operations planned in three countries (USA, Italy, and India).

Which three labels are required when designing the chart of account structure for this project? (Choose three.)

A company implementing Oracle General Ledger has a business requirement to report under two accounting conventions and is considering setting up a primary and secondary ledger. The two accounting standards are very close.

Which data conversion level should you recommend to ensure only manual journals will be entered in the secondary ledger?