What action does an investor take when making a long margin purchase of common shares at market?

Dave purchases 10,000 units of a no-load US-dollar denominated mutual fund for US$15 per unit for a total cost of $165,400 Canadian. He later sells the units for US$16 per unit, with a loss of $11,400 Canadian. To what type of risk has Dave been exposed?

Marc asks his new client for copies of his mortgage documents. Which Know Your Client component is Marc researching?

Danica is looking for a mutual fund to hold in her non-registered account that provides a regular stream of income with potential for capital growth. She is having difficulty distinguishing between bond funds and dividend funds. Which of the following statements is TRUE?

One of your clients, Rakesh, had a portfolio composed of 60% ABC Equity Fund and 40% ABC Bond Fund. Since equities were performing much better than fixed income, he had increased his holdings in ABC Equity Fund to 70% and had reduced his holding in ABC Bond Fund to 30% of his portfolio.

After benefitting the growth in his ABC Equity Fund for over 2 years, Rakesh is uncomfortable with this heavy exposure to equity funds and decides to rebalance his portfolio back to 60% of ABC Equity Fund and 40% of ABC Bond Fund.

He instructs you to switch 10% of the portfolio from the ABC Equity Fund to the ABC Bond Fund.

Which of the following statements is CORRECT?

What does suitability mean?

In which of the following situations would the client mobility exemption apply?

What expense ratio is paid by mutual fund investors for the explicit costs of running the fund?

Which investment securities will change value depending on the price change in the underlying assets?

Which form of investment income is taxed at an investor’s marginal tax rate?

Which example demonstrates direct use of capital savings?

What type of pension plan usually provides better protection against inflation up to the time of retirement?

When comparing mutual funds, what information would help a Dealing Representative determine a suitable mutual fund for a client?

The owners of Underground Airways Ltd. want to take their privately owned corporation public through an initial public offering (IPO). They are speaking to a specialist from an investment dealer to determine

whether it would be advisable to become listed on a stock exchange or the over-the-counter (OTC) market.

In comparing the two options, which of the following considerations is TRUE?

What decision accounts for most of the success or failure of a portfolio?

A client wishes to deal with one registered representative for both banking services and mutual fund investments. The client would also like advice on determining where best to place their money to enhance their overall tax situation as they approach buying a home. Which individual is best suited for this service if the client's goal is to build a long-term advisor-client relationship?

Rebecca, an investor in a 40% marginal tax bracket, receives $1,200 in Canadian dividends eligible for the dividend tax credit. What is the dividend tax credit that applies to this income?

Which of the following is typical for a normal yield curve?

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

Which of the following statements best describes dollar-cost averaging?

Which statement best describes what a rational investor will do when comparing the risk and return of two investments?

In what circumstance would an investor receive a T3 or T5 reporting a capital gain from a mutual fund investment?

When opening a new non-registered account, which client information is optional?

Last year, a hedge fund had a gross return of 22%. The hurdle rate was 5%, and the incentive fee was 20%. What percentage compensation would the fund manager earn for this strategy, assuming no other fees exist?

Which statement best describes key differences between dividend funds and standard equity funds?

Ayan wants to make a registered retirement savings plan (RRSP) contribution and deduct it from his Year 1 income. What is the deadline for this contribution (assume that it is NOT a leap year)?

What is often a requirement of maintaining licensing as a mutual fund sales representative?

What is the level of risk associated with a mortgage fund compared to other types of funds?

Michael had invested in several mutual funds, most of which have appreciated in value. He is not sure if he needs to report the gain as capital gains when he files his income tax return.

What would you tell Michael?

Xian-Li believes she is a sophisticated investor. She has constructed her own portfolio and has had some success. She does not believe in studying a company’s details such as earnings, expenses, or assets. She is more concerned with patterns in a company’s stock price over time. She believes patterns form and can be used to predict future movements in the market.

How does Xian-Li evaluate the companies in her portfolio?

Yesterday, Mariana who is new to investing and purchased mutual funds for the very first time. She shared her excitement with her good friend, Julius. However, after Julius learned about her investment, he admits that he had a bad experience with mutual fund investing and that he lost money. Mariana regrets not talking to Julius prior to making her decision. Her feelings of enthusiasm have changed to fear. She is wondering if it is too late to change her mind and cancel her purchase order.

Which statement regarding the right of withdrawal is CORRECT?

Maureen is 65 years old and will be retiring soon. She has a modest portfolio of mutual funds that focus on growth. As she approaches retirement, Maureen wants to switch to investments that provide steady income with low to medium risk.

Given Maureen’s wishes, which of the following mutual funds would be suitable for her?

What term refers to the minimum rate at which the Bank of Canada lends money on a short-term basis to chartered banks?

What criteria does the independent review committee use to determine if a potential conflict of interest, such as interfund trading, should be approved?

Seth's brother Keith manages a successful private equity fund. Seth is an investment advisor and has thoroughly evaluated Keith's fund. He believes it would be an excellent investment for some of his clients. If Seth does not disclose his relation to Keith prior to recommending this investment, what value does he stand to breach with his client?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

A portfolio manager first analyzes a variety of asset mixes to determine an optimal portfolio and then adjusts the mix by monitoring and rebalancing. What is the name for the process the portfolio manager is following?

Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Which drawback of the comparison universe method makes average fund managers look more like underperformers as the comparison period lengthens?

The ZZZ Money Market Fund has a 7-day yield of 0.05%. What is the current yield for the fund? Round your answer to two decimal places.

When can a mutual fund sales representative disclose confidential client information without informing the client?

You are comparing the performance of ABC Equity Fund and XYZ Equity Fund to their benchmark. Indicate the correct statement.

Return | Year 1 | Year 2 | Year 3 | 3 Year Compound Return

Benchmark | -2.0% | 12.6% | 20.6% | 10.0%

ABC Equity Fund | -10.0% | 16.0% | 24.0% | 9.0%

XYZ Equity Fund | 8.0% | 9.0% | 10.0% | 9.0%

Sean purchases 500 units of Penn Canadian Equity Fund when the net asset value per unit (NAVPU) is $16.70. On December 15, the mutual fund’s NAVPU is $21. On December 16, the mutual fund declares a distribution of $1.25 per unit. Sean’s distribution is immediately reinvested and he purchases additional units of the mutual fund.

Which of the following statements about the effect of the distribution is correct?

What areas are addressed in the Client Relationship Model (CRM) regulation?

How might a registrant provide beneficial mutual fund advice and service?

What value are withdrawals under a ratio withdrawal plan based upon?

What is a requirement when holding an RRIF?

Yesterday, Mariana purchased mutual funds for the first time from Diablo, who is a Dealing Representative for Horizon Financial. When Mariana mentions to her friend Marcus that she just started to invest, Marcus confides that he experienced losses from mutual fund investing. Her initial feelings of excitement have now changed to worry and regret. She wished she had talked to her friend before investing and wonders if she can change her mind.

Which statement regarding the right of withdrawal applies?

The Optima Equity Fund has a beta of 1.4. What is the most accurate way to describe the Optima Equity Fund’s relationship to the market as a whole?

An established securities house in Quebec offers several investment products, including mutual funds and various securities (e.g., bonds and stocks). An administrative employee has brought forward a potential fund trading violation by a registered employee. Immediately following the employee's report what action is most likely to occur?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Michael is trying to determine how much his investments will need to grow to provide for his retirement income. He would like to ensure that his projections factor in the need to maintain purchasing power. What form of return should Michael use in his analysis?

Ayra believes the Canadian economy will be booming for the next five years. Which mutual fund can provide Ayra with the most tax efficiency if she keeps her investment in a non-registered account?

For the last year, an investor earned a return before adjustment for inflation of 2% on a money market fund, while inflation averaged 1.5%. What was his nominal rate of return?

Which of the following applies to a mutual fund trust?

What allocation strategy does an investment advisor apply when adjusting risk and return levels according to behavioural tendencies?

Karen’s know your client (KYC) profile corresponds to someone who has a long time horizon, is comfortable with risk and volatility, and is primarily interested in growth. She watches the daily movements of the Toronto Stock Exchange (TSX) and wants a mutual fund that will closely match what she sees.

What kind of mutual fund would be BEST for her?

What is the most substantial reward for providing excellent customer service as a mutual fund sales representative?

Over the course of a couple of weeks and several appointments, Harold was finally able to provide an investment solution for his new client, Felicia. It was a lump sum investment where they plan to see her

money grow for the next 5 years.

With regards to Know Your Client (KYC) requirements, what are Harold's responsibilities moving forward?

Grant is a Dealing Representative with WealthPlus Securities Inc. Grant becomes a volunteer member of his local arena's Hockey Association and is appointed as the Association's new Treasurer. Which of the

following statements about Grant's appointment as Treasurer is CORRECT?

What is the characteristic of a Stage 2 – Family Commitment investor that most affects the ability to save for the long term?

What bias would influence an investor’s decision to continue to hold an unprofitable investment despite little likelihood of an improvement in the investment’s value?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?

Pierre wants to discuss the merits of a specific mutual fund with his Dealing Representative, Simone. There are no trailer fees associated with this fund. Simone is familiar with the mutual fund that Pierre is referring to, which is not offered by her dealer. They schedule an appointment to further discuss his investment portfolio.

Which behaviour from Simone is ethical?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

Sandra presently participates in her employer-sponsored defined contribution pension plan (DCPP). As contributions continue to be made into her plan, what can she expect?

You ask a new client, Brad, "what are your financial obligations and what are your assets?" What information are you trying to gather in order to comply with the know your client (KYC) rule?

Which of the following actions by the federal government or the Bank of Canada is an example of monetary policy?

Which of the following statements are CORRECT about labour sponsored investment funds (LSIFs)?

The performance of ABC Mutual Fund ranks 54 out of 100 funds in its peer group. What is its quartile ranking?

Natasha currently owns 2 mutual funds: a bond fund and a Canadian equity fund. She would like to use one of them as her registered retirement savings plan (RRSP) contribution for the year. From a tax efficiency perspective, which mutual fund should she contribute?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

A client had set up a voluntary accumulation plan to invest a set amount annually in December in an equity mutual fund. They decided to move to a pre-authorized plan where they will invest a smaller amount in this fund every week. What is likely the most significant benefit of this change?

An increase in which factor is a result of a deflationary environment?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?

Loretta is looking for a well diversified equity fund. Her ideal mutual fund would hold investments within and outside Canada. Although she is seeking growth, Loretta also wants a mutual fund that invests in quality companies.

Which of the following mutual funds would be the best choice for Loretta?

Which client has demonstrated the endowment behavioural bias?

What type of mutual fund seeks to provide a positive real rate of return, through both income and capital appreciation, by investing in a diversified portfolio of fixed income securities, as well as Canadian and foreign equity securities?

What asset class would have the highest level of expected volatility?

Ai Fen has recently become registered to sell mutual funds with Acadian Eastern Financial, a mutual fund dealer. Ai Fen determined that with her background of being a Chartered Financial Analyst, she can help people understand the nature of investing more easily than others in her field.

Which registration category will need to be prominently noted on Ai Fen’s business card to comply with the “holding out rule”?

Fred's client, Matteo, holds a technology-themed mutual fund. The fund's investment objective recently changed, allowing it to hold various cryptocurrencies, resulting in a high-risk rating and making it unsuitable for Matteo. Fred discussed the change with his client, but Matteo insisted on continuing to hold the fund. What action must Fred take?

What amount of Canadian taxes would an investor with a 33% marginal tax rate pay on a $5,000 dividend payment from a foreign corporation?

Which of the following individuals would qualify for a full or partial Old Age Security (OAS) pension?

What statement shows a company’s position at a specific date?

What does relative performance seek to compare between a fund and the other funds in its category?

When selecting an investment to add to a portfolio, what feature would reduce the overall risk?

Using historical market data, which investment strategy's purchasing power is least susceptible to inflation risk?

Fernanda, an advisor, is setting up her process for completing client suitability assessments. What must Fernanda do with respect to investment suitability?a

When reviewing a company's balance sheets, what ratio best determines whether their borrowing is excessive?

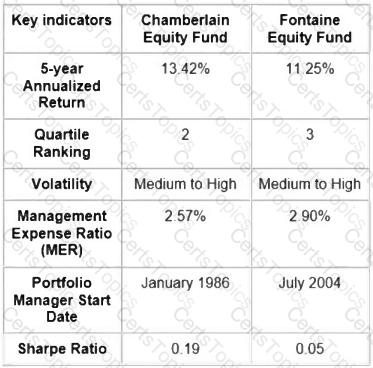

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Which of the following transactions takes place in the secondary market?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Which of the following best describes how a target date fund works?

What is the securities administrator’s power that is intended to ensure investors can make fully informed investment decisions?

What party is responsible for ensuring that a public corporation's total number of outstanding common shares does not exceed its total number of authorized shares?

Your client’s unused RRSP contribution room is $46,000. He contributes $15,000 in the current taxation year. How much RRSP contribution room can he carry forward?

On which of the following does the Personal Information Protection and Electronic Documents Act (PIPEDA) impose requirements?

For what reason do different entities have securities created and sold?

A self-directed investor bases stock purchase decisions on internet recommendations and stock tips, believing this provides the most accurate information. What is the investor's behavioural bias?

All other factors being equal, which fund outperformed the benchmark during this period? The benchmark return is 4.75%.

Fund

Starting NAV ($)

Ending NAV ($)

ABC

21.15

22.09

FED

25.37

26.61

MCQ

30.14

31.55

XYZ

31.00

31.99

Barend is a Dealing Representative with Planvest Group Inc., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following CORRECTLY describes

Barend's obligation for conflicts of interest?

Which exemplifies the tendency of mutual fund companies to shut down poor performing funds?

Which company usually fills the role of the custodian for a mutual fund?

Your client, Helen, just received her non-registered account statement which states that one of her mutual funds made an interest income distribution during the year. She asks you how she will be taxed on the distribution. What do you tell Helen?

Your clients, Philip and Helen, have a disabled son, Alex, age 22. They want to set up a registered disability savings plan (RDSP) for Alex and have asked you for some information.

Which statement is TRUE?

What type of fee does a mutual fund sponsor often reduce the longer an investor holds a back-end load fund?

Details of a client's investment portfolio appear in the following table:

Type of Funds

Amounts Invested ($)

Canadian equity growth fund

15,000

TSX equity index fund

25,000

Canadian resources fund

75,000

Canadian equity value fund

95,000

What is the primary risk of this investment portfolio?

Dakota is a Dealing Representative with Harvest Wealth Inc., a mutual fund dealer. Dakota starts a marketing campaign to contact prospective new clients and increase sales with existing clients. Which of the following CORRECTLY describes activities that Dakota can engage in under her marketing campaign?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

Jehona is a Dealing Representative with Vista Wealth Investments Inc., a mutual fund dealer in Ontario and Nova Scotia. Jehona has reviewed her client Sokol’s account and wants to adjust the holdings and re-balance the portfolio. Which of the following statements about Jehona’s permitted activities is CORRECT?

Which of the following Dealing Representatives has fulfilled their "Know Your Product" obligation?

What is the time period during which an individual must complete a training program once she starts acting as a dealing representative?

Martine is working with Ishmail, her financial advisor, to develop her client investor profile. In her overall risk profiling, it was determined that Martine could tolerate an asset allocation of up to 70% of her portfolio. She currently has a goal of saving for a down payment for her first home, saving for her young children's education and retirement. Ishmail uses a one-fund strategy for all his client accounts - Martine would be allocated the "growth" fund to all her investments and savings under his management. What should be Martine's most significant risk in using this strategy at this stage?

Bernadette has a high-paying job and is in the top tax bracket. She recently received a payment of $5 million upon the settlement of her uncle's estate. Bernadette would like to invest her inheritance in financial products that would not only grow her money but is also income tax friendly.

Which of the following would provide the most favourable tax treatment?

Which statement CORRECTLY describes index mutual funds and traditional exchange-traded funds (ETFs)?

Based on the financial planning pyramid, what security would be appropriate for a very aggressive investor?

Which feature would be of prime importance for a money market mutual fund?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

Carol contributed $500 to her TFSA. $350 was invested in ABC Bank Canadian equity fund and $150 in the ZYX Global growth fund. The expected return for the funds is 8% and 9.8%, respectively. What is the expected return on her TFSA?

Tristan is evaluating different mutual fund options for his client. What mutual fund option would be the most expensive to buy in dollar terms?

Which of the following form part of the disclosure documents relating to mutual funds?

Wilma has always used the services of a tax preparation firm to file her taxes but is skeptical that she has really benefitted. This year she plans to file her own taxes for the first time.

What would be useful for her to know?

An investor who wants to deplete their funds within the next five years is considering various withdrawal plans. Assuming the investor is less concerned about predictable annual cash flows, what withdrawal plan type is most appropriate for the investor?

Derek submits an order to sell 300 units of the Evergreen Canadian Mortgage Fund at 8:00 p.m. EST on Friday, January 6. His proceeds will be based on the net asset value per unit (NAVPU) for which day (assume no holidays)?

A husband wishes to transfer some of his non-registered mutual fund holdings to his wife, but wants to maintain trading authority over the transferred assets. He also wishes to ensure that should she die, the gift he is making will revert to him. What is the appropriate account type?

What does PIPEDA require firms in Canada to do?

Your client, a high-income earner in a high marginal tax bracket, is seeking to minimize the amount of tax he pays on investment income while continuing to invest in mutual funds. Which mutual fund would best meet his investment objective?

When you buy a put option, which of the following is TRUE?

Apex Mutual Fund has been structured to avoid taxation by distributing any net interest, dividends, and capital gains to unitholders each calendar year. This is an example of what type of mutual fund structure?

Sylvia decided to use the savings from her bank account to purchase a 5-year bond. The face value of the bond is $10,000, the market price is $9,230 and the coupon rate is 7%.

What is the current yield on the bond? Round to 2 decimal places.

The Mutual Fund Dealers Association of Canada (MFDA) has strict rules concerning conflicts of interest. Which of the following is TRUE?

Leira has a marginal tax rate of 45% and may deduct $5,000 in registered retirement savings plan (RRSP) contributions on her income tax return. If she decides to use her available deduction and assuming

this does not reduce her taxable income to a lower tax bracket, by how much will it reduce her tax payable?

Daisy is a Dealing Representative registered in the province of Saskatchewan only. Daisy’s client, Orville, a resident of Lloydminster, Saskatchewan is a retiree who presently has a $1,000,000 with her dealer, Easy Ride Financial. Orville is now planning to move to Vegreville, Alberta next month. Easy Ride Financial is registered in Alberta and Saskatchewan. Neither Easy Ride Financial nor Daisy have any clients who are resident in Alberta.

Which of the following should Daisy do if she wants to continue to service Orville’s account?

Which investor's needs would be BEST met with an income trust?

What do Guaranteed Income Supplement (GIS) and Allowance for the Survivor have in common?

As it pertains to fixed-income securities, which yield metric factors in cash flows relative to ongoing bond prices rather than the initial amount invested?

How is the annual contribution limit for a TFSA determined?

Sujay contributes 3% of his $60,000 salary to his employer’s defined contribution pension plan. His employer contributes the same amount to the plan. How will this affect his registered retirement savings plan (RRSP) contribution room for the year?

Samantha will be retiring from her full-time job when she turns 60 and would like to use her non-registered investment plan as income until she is eligible to receive her full pension benefit at age 65. What systematic withdrawal plan should she choose?

An investor purchases units of an equity fund for $17.60. In which of the following circumstances would an investor potentially owe taxes on capital gains?

Vickie recently added the ABC Investco EV Fund to her portfolio. This fund invests in global companies involved in the electric vehicles sector. What type of mutual fund is this classified as?

Which of the following statements is true when comparing fund of funds to traditional mutual funds?

Which of the following is included when calculating a country's gross domestic product (GDP)?

At what age must an RRSP be terminated?