The suspense account of a company was opened with a credit balance of $360 when the trial balance failed to agree.

This could have arisen because

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.

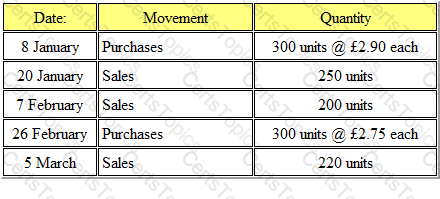

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. Opening inventory at the beginning of the period was 200 units @ £2.80 each. During the period the following movements of inventory were recorded.

The value of the closing inventory at the end of the period and amount charged to the income statement were:

Which TWO of the following are treated as statutory deductions from an employee's gross salary?

Which THREE of the following are subsidiary bodies of the IFRS Foundation?

ABC Limited had a gross profit margin of 55%, while a direct competitor, XYZ Limited, has a gross profit margin of 60%.

Which THREE of the following would be an acceptable explanation for this?

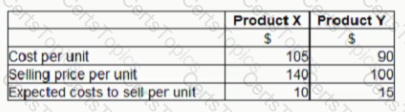

AB sells two products ,X and Y. The following information was available at AB’s year-end, 31 December 20X6:

At 31 December 20X6 AB held 800 units of Product X and 400 units of Product Y

What is the value that will be included in inventories in AB's statement of financial position as at 31 December 20X6?

A company uses the reduced balance method of depreciation for its company vehicles. The vehicles are depreciated at a rate of 30% per annum.

On 31 March 2003 the company purchased a number of vehicles with a total cost of $200,000. The company's year-end is 31 December and it is company policy to charge a full year's depreciation in the year of acquisition.

The carrying value of the vehicles at 31 December 2006 will be

Which of the following is the best definition of the objective of accounting?

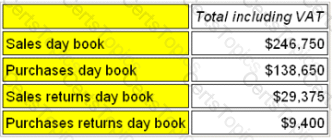

Refer to the Exhibit.

A company that is VAT-registered has the following transactions for the month of March.

All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The movement on the VAT account for the period was:

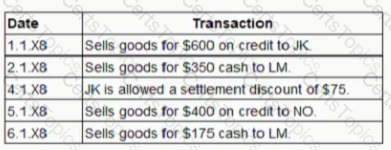

GH has the following transactions for the week of January 20X8:

GH is not registered for sales tax

What is the total of the sales day book for this week? Give your answer to the nearest whole number:

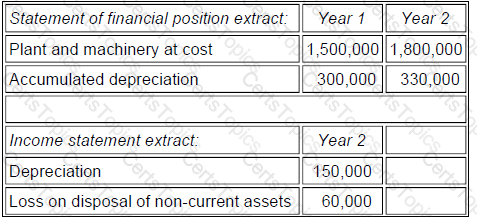

Refer to the Exhibit.

The following information is available relating to the non-current assets of Company X:

Non-current assets that had originally cost $225,000 and had a carrying value of $105,000 were sold during the year.

The figure for purchases of non-current assets to be shown in the statement of cash flows will be, to the nearest $1,000:

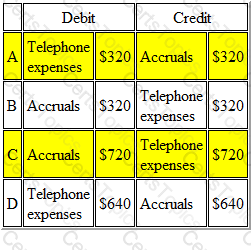

Refer to the Exhibit.

A company is preparing its accounts to 30 April 2006. The latest telephone bill received by the company was dated 31 March and included call charges for the quarter 1 December to 28 February. The amount of the bill for call charges (excluding VAT) was $960. Most of the company's telephone bills are for similar amounts.

Which of the following journal entries should be made to the company's accounts at 30 April 2006?

The journal entries which should be made to the company's accounts at 30 April 2006 is

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

Which TWO of the following are characteristics of financial accounts?

Where a transaction is entered into the correct ledger accounts, but the wrong amount is used, the error is known as an error of

Which of the following is not a correct definition of the accounting equation?

The profit earned by Subramanian in 2006 was £ 50,000. He injected new capital of £12,000 during the year and withdrew goods for his private use that cost £4,000.

If net assets at the beginning of 2006 were £10,000, what were the closing net assets?

A company has a receivables balance at the end of the year of £120,000. The company maintains an allowance for receivables at 3% of closing receivables. The opening balance on the allowance was £ 2,880. During the year bad debts of £ 3,000 were written off

The total charge for bad debts for the year is £

Which of the following is an error of principle?

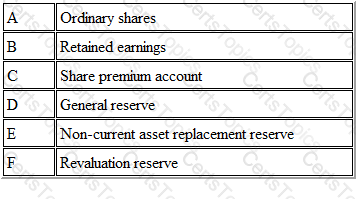

Refer to the exhibit.

Which three of the following would be classified as a revenue reserve?

Financial controls are needed in order to:

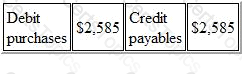

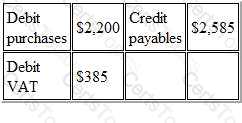

A company which is VAT-registered receives an invoice for goods purchased for resale totaling $2,585 from a supplier that is not VAT-registered. VAT is at the rate of 17.5%.

The correct entry to record the invoice is:

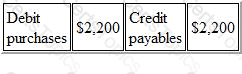

A)

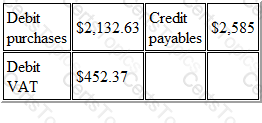

B)

C)

D)

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

Refer to the Exhibit.

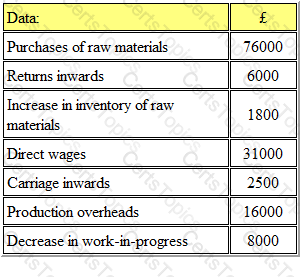

The following information is given at a manufacturer's year end:

Using some or all of the above figures, the correct figure for factory cost of goods completed is:

Goodwill is calculated as being:

What is the balance of the trading account?

Which ONE of the following does not apply to the preparation of management accounts?

What will be the effect on the financial statements if the closing inventory figure is decreased?

Your company provides a number of staff with lap-top computers, as well as pocket calculators. It capitalizes the cost of the computers and depreciates them over several years, but writes off the cost of the pocket calculators in full, against profits, in the period in which they are purchased.

The main justification for this difference in treatment is:

Which one of the following best describes the stewardship function?

A company's cashbook has an opening balance of £4,860 debit. The following transactions then took place:

(a) Cash sales - £23,500, including VAT of £3,500

(b) Receipts from customers - £18,600

(c) Payments to payables £12,400, less cash discounts of £240

(d) Bank Charges - £260

What will be the resulting balance in the cash book?

Accounting codes have proven to be very useful when recording business transactions.

Which THREE of the following does a coding system help to do?

In which section of the statement of cash flow would cash from share issues be included? Select one of the following

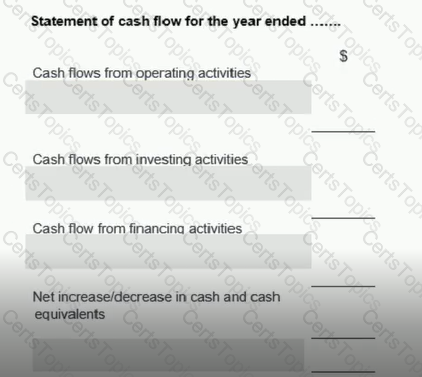

Statement of cash How for the year ended.......

An invoice for electricity has been debited to the supplier's account and credited to the electricity account. This would result in:

The accounting concept which states that non-current assets should be valued at cost (or valuation) less accumulated depreciation, rather than their saleable value in the event of closure, is the.

Which one of the following is unlikely to be identified by the ratio analysis of a company's financial statements?

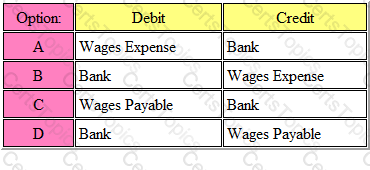

Refer to the Exhibit.

The correct ledger entry for payment of net wages to employees is:

The answer is:

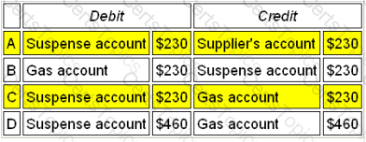

Refer to the exhibit.

A suspense account shows a credit balance of $230 which has arisen because of the recording of a gas bill twice in the gas account.

In order to correct the error, which one of the following journal entries is required?

The correct journal entry is

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

Which THREE of the following are improved by the use of accounting standards?

If closing inventory at the end of an accounting period is overvalued by £2000 and no adjustment is made, the net profit in the following accounting period will be:

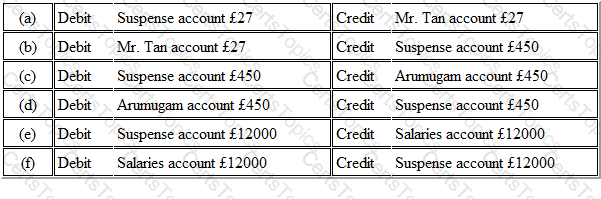

Refer to the exhibit.

The trial balance of Monchu Partnership, as at 30 June 2006, has a suspense account. Subsequent investigations revealed that:

(1) A payment of £352 to Mr. Tan was posted as £325.

(2) A remittance of £450 received from Arumugam was credited to Armits accounts.

(3) Salaries of £12000 have not been posted from the cash book.

Monchu suggested the following adjustments:

The appropriate journal entries are:

If an auditor expresses an opinion of `fair presentation' on a set of financial statements, this means:

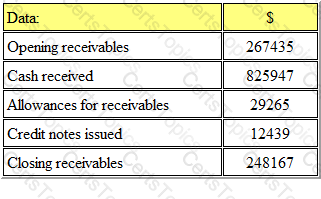

Refer to the Exhibit.

From the following information, calculate the value of sales for the period:

Value of sales is

Before lending to an entity, which TWO of the following pieces of information would a potential lender want to consider?

A company has total equity of $350,000 and a 5% debenture of $150,000. The net profit before interest for the period was $60,000.

The return on equity is

Life membership fees payable to a club or society are usually dealt with by:

The financial accounts, as prepared by the directors of a company, are required to show a 'true and fair view'. This means that:

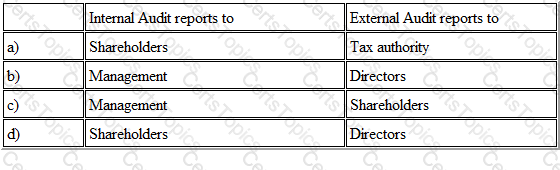

Refer to the exhibit.

Both internal and external audits can be performed on the financial statements of a company. The results of the audits have different purposes and different reporting lines.

Which of the following combinations is correct?

If a profitable entity is not required to register for sales tax with its local tax authority, which of the following statements is TRUE?

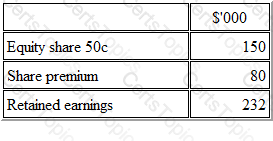

Refer to the exhibit.

ABC has the equity balances at the end of year 1.

During year 2 ABC issues 100,000 new shares at a price of $1.10

What is the balance on share premium at the end of year 2?

Which of the following transactions would be classified as a capital transaction?

Which one of the following would not be classified as an efficiency ratio?

Which of the following transactions affects profit but does not affect cash?

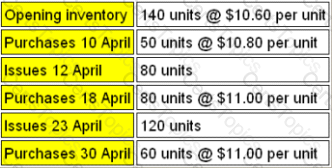

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. The following information is available for the month of April:

The closing value of inventory at the end of the month of April is

Which THREE of the following are characteristics of financial accounting?

The sales ledger control account shows a balance of $267,984 whilst the individual customer account balances total $262,856.

Which of the following is a possible explanation for the difference between the two?

(i) A payment has been recorded in the cashbook but not in the sales ledger

(ii) A payment has been recorded in the sales ledger but not in the cashbook

(iii) An invoice has been recorded in the sales ledger but not in the sales day book

(iv) An invoice has been recorded in the sales day book but not in the sales ledger