Portfolio A had a return of 12% in the previous year, while the market had an average return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the standard deviation of the market was 15% over the same time period. If the correlation between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

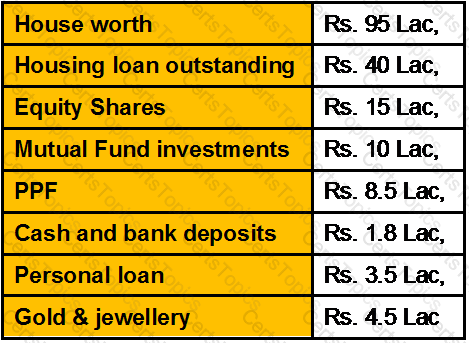

Calculate the Net worth of Mr. Surinder Nath with the following financial details as:

Rahul had invested in an open ended Mutual Fund when the NAV of the fund was Rs. 10. After 6 months the NAV was Rs. 12. Calculate the annualized percentage change in the fund ignoring all charges.

The relevant banking ombudsman for filing a complain regarding credit card with central processing is the one under whose jurisdiction __________________?

The share of a certain stock paid a dividend of Rs.10.00 last year. The dividend is expected to grow at a constant rate of 15 percent in the future. The required rate of return on this stock is considered to be 18 percent. How much should this stock sell for now? Assuming that the expected growth rate and required rate of return remain the same, at what price should the stock sell 4 years hence?

A borrower defaults on a secured loan of Rs. 50,000. The underlying security is worth Rs. 60,000. Which of the following is true? "

Sujoy has purchased shares of Rs.12500 of common stock in Hindustan Unilever . He has recently sold investment to the tune of Rs.15000 & received Rs 2500 as cash dividends during the holding period of 4 years. He paid a total of Rs 250 in commissions. What is CAGR on the investment?

Vinod had taken a housing loan of Rs. 15 Lakh disbursed on 1st April 2006. They are presently paying an EMI of Rs. 17,285 at the end of every month beginning from the month of disbursement. The loan is at fixed rate of interest of 11.25% p.a. (reducing monthly balance basis) with tenure of 15 years. He wants to know what amount is eligible for deductible u/s 24 of Income Tax for housing loan repayments in computation of his Income tax liability for AY 2011-12.

To check inflation, RBI should:

The main purpose of the guaranteed insurability rider benefit is to give the policyholder the right to

Mrs. Sharma, a 40-year-old widow, has an 8-year-old son. Her current savings are not adequate to provide for her son’s post graduate studies, however she will be able to save for it by the time he finishes graduation i.e. when he is 20 years old. Mortality tables indicate that her life expectancy is another 30 years.

Which one of the following is true?

A maximum of _____% of the issue would be allotted to one single QIB

In straight line method

What is the exemption criteria U/S 10(10) (ii) of the IT Act, 1961 for any gratuity received by a seasonal employee?

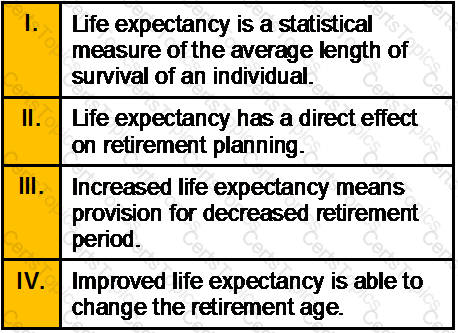

Which of the following statement is true in relation to life expectancy?

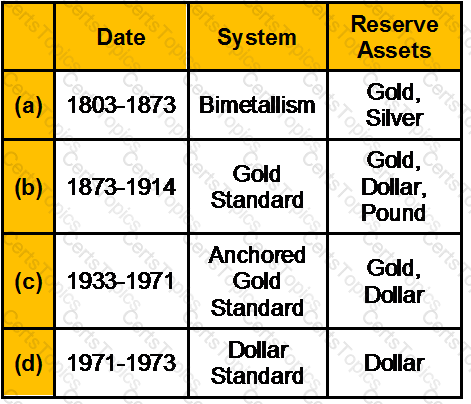

Which of the following is/are the incorrect pairing in the history of exchange rate regime?

Dividend per share of Books Ltd. is 2 and required rate of return is 10%. Calculate the value of share of Books Ltd.

Compulsory maintenance of account is required u/s 44AA of IT, if the gross receipt/ total sales exceed _______

Mr. Gupta has got his stock insured against fire for Rs5,00,000/- ,during the year he lost the stock in his ware house for Rs. 4,00,000/-. The surveyor from insurance company gave his report that at the time of fire the stock in the ware house had value 6,00,000/-

Calculate what amount Mr. Gupta will receive from the insurance company.

Which of the following taxes are allowed as deduction while computing the business income?

Calculate premium payable for term insurance policy of Rs. 10 lacs, for a group of 278 people of 39 years of age. The Mortality Table shows that in this age group 2,681 people die every year in a group of 12,50,000.

Girish is 25 years old and plans to retire at 60. His life expectancy is 75 years. Mr. Binoy his CWM® estimates that his client will require Rs. 45,000 in the first month after retirement. Inflation rate is 5% p.a. and the rate of return is 7% p.a. How much she should save every year in order to achieve her post retirement needs?

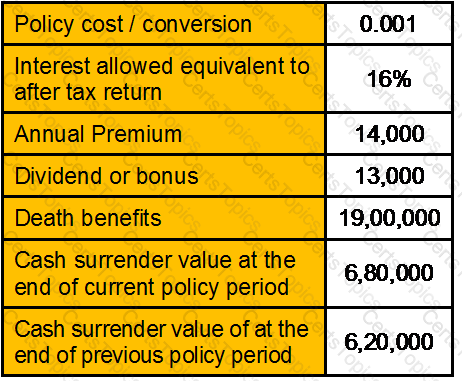

Derive policy cost per thousand with following data:

Movement through phases of the business cycle is initiated by shifts in aggregate demand which create fluctuations in GDP. Which combination of the following statement would be the most significant contributor to the upward shift in aggregate demand?

Major phases of budgeting process are:

The shares of Alpha were bought on Jan 1 for Rs 110/-. During the year Alpha paid a dividend of Rs 2/- per share. At the end of the year, share of Alpha was sold for Rs 115/- What is the total return on Alpha?

The beta of stock of Akhil Computers Ltd., is 1.5 and is currently in equilibrium. The required return on the stock is 19% and the expected return on the market is 15%. Suddenly due to a change in economic conditions, the expected return on the market increases to 17%. Other things remaining the same what would be new required rate of return on the stock?

You buy a new computer for your business costing approximately Rs. 5,000. You expect a salvage value of Rs. 1000 selling parts when you dispose of it. Your business has upgraded its hardware every four years, so you think this is a more realistic estimate of useful life, since you are apt to dispose of the computer at that time. Calculate the amount of depreciation using straight line method?

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceed _______

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary Basic Salary 2000 / DA 1000/ HRA 500. How much gratuity is payable to him?

Fine in case of cheque bouncing can go up to _________.

Consider two bonds, X and Y. Both bonds presently are selling at their par value of Rs.1000. Each pays interest of Rs.150 annually. Bond X will mature in 6 years while bond Y will mature in 7 years. If the yields to maturity on the two bonds decrease from 15% to 12%:

Liability of a member in case of a private company is

The following is an exempt income:

Which of the following assets not included in calculating wealth tax?

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. Said rent is —

In case where amount of wealth tax exceeds one hundred thousand rupees rigorous imprison-ment for a term not be less than …………

Intrinsic value of a stock is

SHG stands for:

Compute Geometric mean return for an investment with the following per period return – 8.9%, 10%, 7.7%, 13%?

What is a valuation date?

Forward contracts are

Which of the following is not a key issue in retirement planning?

Which of the following measure is most widely used as an indicator of inflation?

Often burdened with loan and generally both of the spouses work to earn their living. Under which category this type of family falls?

In addition to the contribution employer has to pay ______________% of wages as administration charges.

Cash credit is treated as out of order if ____________.

Rate of interest in post office MIS is

In PPF the term/duration of the account is 15 years from :

Which one of the following sections of the Transfer of Property Act, defines ’Notice’

Receipts from TV serial shooting in farm house is __________________

Dividends received from investment would be classified as:

Where one can open an account under the Public Provident Fund Scheme, 1968?

Customers with poor credit history due to defaulting payments is ………………

What is codicil?

Where the return of income is filed after the due date specified u/s 139(1):

Which of the following statements is/are false?

Sponsor of a Mutual Fund is like a promoter of a company

The following is not ‘plant’ u/s 43(3) of the Income-Tax Act, 1961

Which of the following is not true about traditional defined benefit plans?

Any amount payable and the amount of refund due under the Income Tax Act,1961

shall be rounded off to the nearest multiple of.......... ?

A return relative is

In “Teenage Years” life stage, one learns about ___________

When there are more than one trustees for a trust the execution can be done by a single trustee instead of jointly

Generally speaking, high severity of losses will be accompanied by

The minimum capital that a private limited company needs to commence business is:

During inflationary period, nominal interest rates are ________ than real interest rates.

_______________ and _______________ mandates are two kinds of service level contracts

Money Laundering:

Your client Mr. Singhania expressed his intention to write his will in his own handwriting such a will which is wholly in the handwriting of the testator is renown as:

Minimum number of independent directors on the board of Asset Management Company is

If there is a loss under the head Income from House property, can it be adjusted against other income under any other Head?

“Income rule” in Insurance advocates

Which is not the condition for getting superannuation fund approved?

Which of the following is a self funded retirement security?

High powered money refers to.................

The Basel Committee has defined gross income as net interest income and plus net non-interest income and has allowed each relevant national supervisor to define gross income in accordance with the prevailing accounting practices. Accordingly the Reserve Bank of India in the draft guidelines issued on 11.03.2005 for implementation of the new capital adequacy framework has modified the Gross Income definition slightly. The Net Interest Income has been replaced by

All the following statements concerning unsystematic risk are correct EXCEPT:

According to the capital asset pricing model, fairly priced securities have __________.

A type of lease where there is no payment schedule and penalty for a set period of lines.

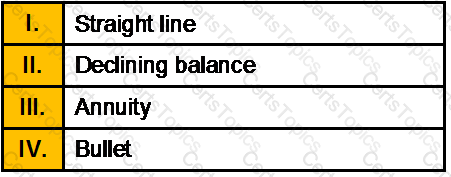

Which of the following is/are the different kinds of amortization?

Risk can be

If the slope of the Security Market Line is zero, which of the following is/are true?

GDP refers to ..............

The organization which was established in year 1956 to provide various forms of financing without soverign guarantees, primarily to the private sector is:

In marine insurance claims, insurable interest must shown to exist at the time of

A Foreign Bank is one

A security's beta coefficient will be negative if _____________.

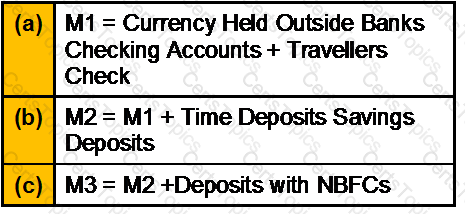

Which of the following definitions of forms of Money are correct?

The premium on all other riders put together should not exceed _____ of the premium on the base policy

Doctrine of subrogation applies only to

What is the most essential characteristic to be in existence at the stage of establishing client relationship?

Benefit of investing in a share is /are

Which of the following statement is correct?

Indian Inherihence Law permits a married woman to acquire jewellery to worth of?

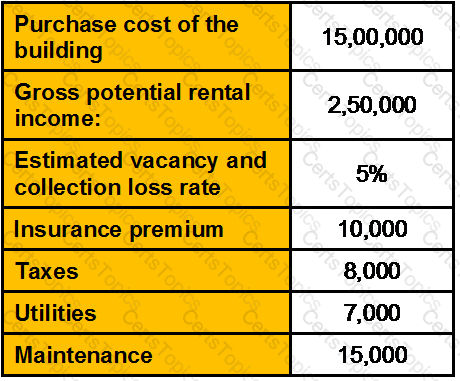

An investor is considering the purchase of a small office building and, as part of his analysis, form the following given data calculate the Net Operating Income (NOI)?

Ramesh retired as General Manager of XYZ Co. Ltd. On 30.11.2012 after rendering service for 20 years and 10 months. He received Rs. 300000 as gratuity from the employer. (He is not covered by Gratuity Act, 1972).

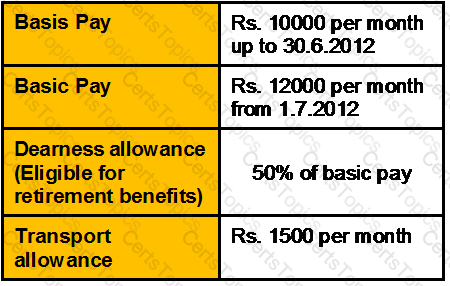

His salary particulars are given below:

He resides in his own house interest on monies borrowed for the self occupied house is Rs. 24000 for the year ended 31.03.2013

Compute taxable income of Ramesh for the year ended 31.03.2013.

R acquired a property by way of gift from his father in the previous year 1991-92 when its FMV was Rs. 3 lakh. The father had acquired the property in the previous year 1983-84 for Rs. 2 lakh. This property was introduced as capital contribution to a partnership firm in which R became a partner on 10/06/2011. The market value of the asset as on 10/06/2011 was 10 lakh, but it was recorded in the books of account of the firm at Rs. 8 lakh. Compute the capital gain chargeable in the hands of R.

Vinod Khanna, aged 27 years, is having a policy of Rs. 15 Lac sum assured and is paying premium of Rs. 14,800/- . The cash surrender value of this policy is at the end of previous year was Rs. 35,000. It is estimated that by this year end, the cash surrender value of this policy would be Rs. 40,000/-. Bonus under this old policy is Rs. 10,000/-.

There is another term insurance policy of Rs. 15 Lac Sum Assured is available to Vinod at Rs. 4,200/- per annum. If rate of interest is 8 % then first calculate the CPT of existing and new policy respectively and then advise Vinod if it is better to continue this policy or to discontinue it?

A stock earns the following returns over a five year period:

What is the standard deviation of returns for the stock?

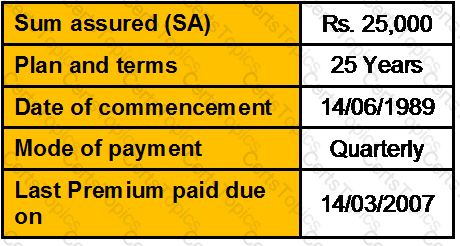

Calculate the Paid up Value ( PV) under a policy with the following particulars:

Consolidated Reversionary Bonus declared by the insurer from March, 1990 to March 2006 is 550/- per thousand sum assured. Bonus declared for the year ending March 2007 is @ Rs. 70/- per thousand.

Saurabh contributes Rs. 10,000 every year starting from the end of the 5th year from today till the end of 12th year in the account that gives a ROI of 7.75% p.a. compounded half yearly. Calculate the Present Value of his contribution today.

Dinesh took a housing loan of Rs. 25,00,000/- for 15 years in 2010 at a ROI of 11.75% per annum compounded monthly. Calculate the total interest and principle paid by him in the 2014 and 2016.

A)

B)

C)

D)

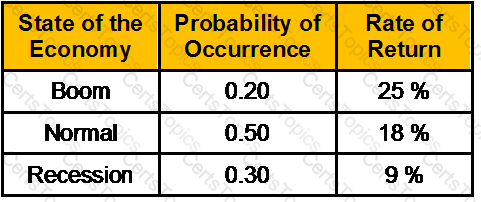

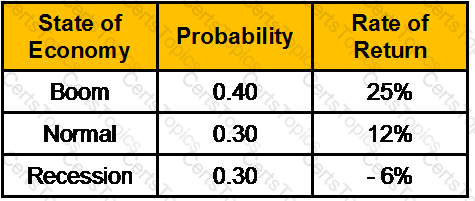

The probability distribution of the rate of return on a stock is given below:

What is the standard deviation of return?

Mr. M is an employee of Z Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. M and examine whether he is a specified or non-specified employee?

A stock caries the following returns over a five year period:

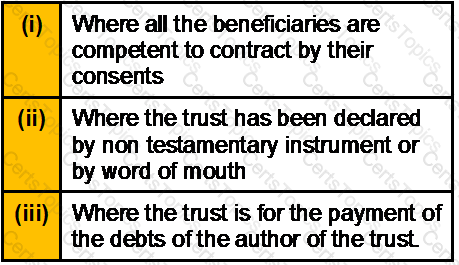

A trust not created by a will can be revoked only

Rhona has a daughter Zena five years old. She wants to plan for Zena’s education and has found out that she would be requiring 2,75,000 at her age 18 and another 4,50,000 on her age 25. She also wants to have Rs. 10,00,000 for Zena’s Marriage which she expects at the age of 28. She wants to deposit the entire amount for these expenses today in an account that pays a ROI of 15% per annum compounded annually. What would this amount be?

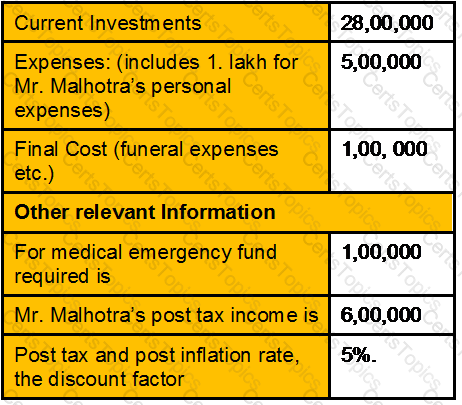

Mr. Malhotra and Mrs.Malhotra aged 50 and 45 years respectively, both have a life expectancy of 35 years.

You have following information

Calculate the adequate insurance required based on need based approach.

Mr. Ravi aged 28 years is a marketing professional who earns a salary of Rs. 50000 p.m. He is very concerned about his retirement expenses. For the same he has started saving Rs. 6000 p.m. regularly in a bank fixed deposit paying an interest of 9.5% p.a. since the age of 23.

At the age of 38, he is thinking of buying a house on his retirement which is 25 years away.

He has estimated that the price of the house at his retirement will be Rs. 4000000. Calculate the amount of retirement corpus accumulated by him and the extra savings he has to make at the age of 38 in order to purchase the house? (Inflation rate = 3% p.a.)

Mr. Sachdeva is working as a regional head in a Pharmaceutical Company in New Delhi. He has a annual income of Rs. 10,00,000. His current expenses are Rs. 5,00,000 and he will be retiring in next ten years . The inflation rate for the foreseeable future is expected to be 5%. He assumes that his post retirement expenses will be 70% of his last year expenses of his service and they will increase at inflation rate and paid at the beginning of each year.

On his retirement he plans to leave his current rented apartment and shift into a another apartment located in NCR . The current price of the bungalow is Rs. 24 lakh which is estimated to increase in line with inflation rate. A ten year government security paper fetches 10% interest rate, which will remain constant for the forthcoming period. He is in good health and expects to live for twenty years after retirement.

As a CWM you are required to calculate the amount Mr. Sachdeva needs to save at the end of ten years on an annual basis so that he can pay his post retirement expenses as well as to buy the apartment.

Savitri is 30 years old. She saves Rs. 14,000/- p.a. (year end) in FD 8.75% p.a. compounded annually until she retires at age 58. Her life expectancy is 80 years. What would be her corpus at the time of retirement? What is the fixed amount she can withdraw at the beginning of each year, until age 80, in case she wishes to exhaust the whole corpus? Inflation is 5%.

Mr. Aakash Jain has invested Rs. 85,000/- @ 6% p.a. in a bank deposit on 15th May 2007. After 10 years of investment rate of interest changes to 8 % p.a. computed half yearly. Further after 5 years rate of interest again changes to 7% p.a. compounded quarterly. After further 3 years rate of interest again changes to Rs. 7% pa compounded monthly. What will Mr. Jain get after 23 years (14th May 2030) assuming the date of commencement is now?

You wish to save for your son’s education the present cost of which is Rs. 320000 and is expected to increase by 6% every year. If your son is 12 years old and will require money in 8 years time, what is the annual amount of investment to be made if it is likely to earn 12% rate of return?

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the amount in the account after 6.50 years.?

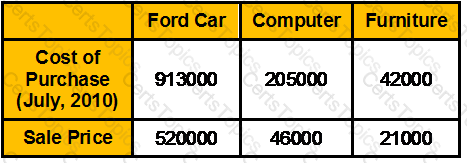

Find out the taxable value of perquisite from the following particulars in case of an employee to whom the following assets held by the company were sold on 1.8.2012.

The assets were put to use by the company from the day they were purchased.

Vikas is 35 years old working as a regional head of a multinational bank and plans to retire at 55 and is earning a salary of Rs. 4,00,000/- p.a. His life expectancy is another 15 year after retiring. He is able to save Rs. 85,000 /- p.a. (END) and regularly invests it in a 6% p.a. investment plan.

Calculate what will be the Vikas’s total accumulation at his retirement? And how much he can spend per every year at beginning if he dies at the age of 70 and assuming that he leaves behind Rs. 1,00,000/- as estate.?

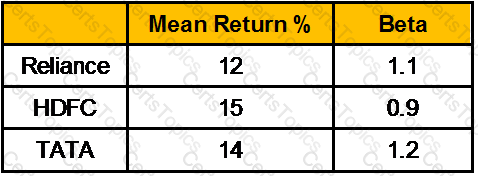

Consider the following information for three mutual funds

Risk free return is 7%. Calculate Treynor measure?

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

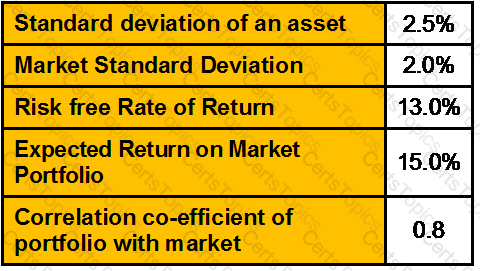

Case: Read the data given below & answer the following questions:

Market sensitive index will be:

A rate of interest of 10% semi-annual compounded quarterly would be equal to -------------------- % per annum compounded annually.

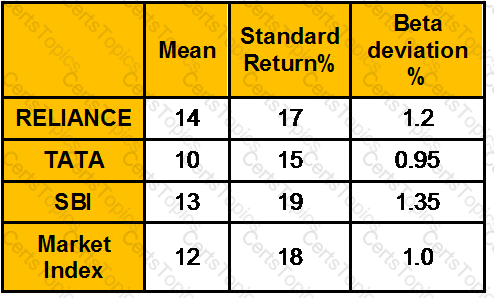

Mentioned below is the information regarding three mutual funds - Reliance, TATA, SBI and the Market Index.

The Risk free return rate is 5%. Calculate the Jensen Measure of RELIANCE, TATA, & SBI Fund.

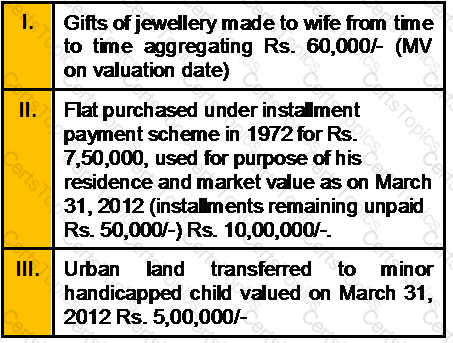

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

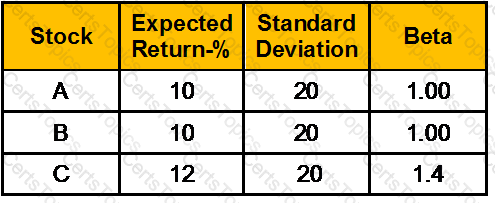

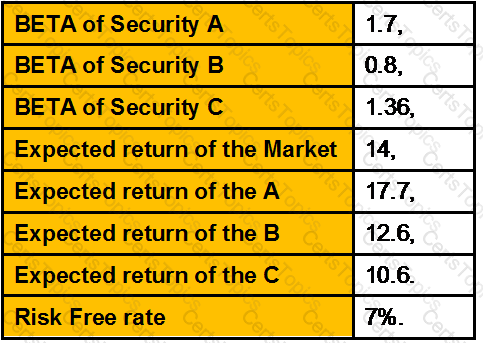

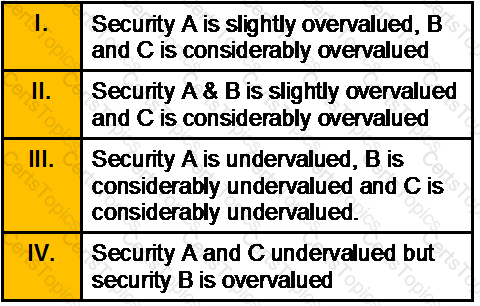

Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

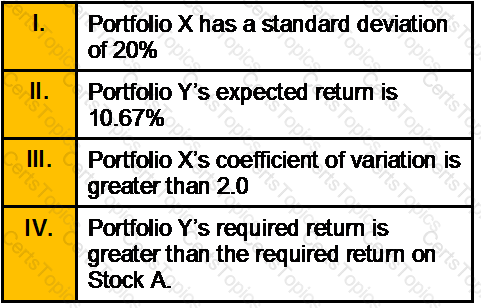

Which of the following statements is/are correct?

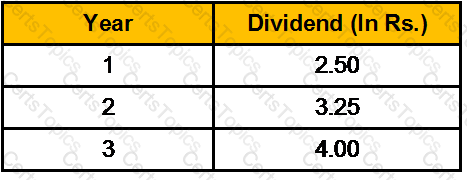

The management of Pearls India Shopping Ltd has recently announced that expected dividends for the next three years will be as follows:

For the remaining years, the management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Samantha celebrated her 21st birthday today, her father gave her Rs. 6,25,000/- which is deposited in a account that pays a ROI of 12.25% p.a. compounded monthly. If she wants to withdraw Rs. 7,50,000 on her 31st. Birthday and balance on her 41stBirthday. How much can she withdraw on her 41st. birthday.?

Consider the following information:

Which of the following statements is/are true?

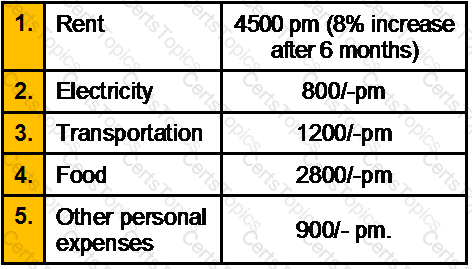

Suresh a 30 years old person has joined ABHG on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 20500.His monthly expenses details are as follows:

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450. What will be his cash in hand on 31/03/2007.

A bond with a face value of Rs. 1000, returns Rs. 80 in year 1, Rs. 80 in year 2 and Rs. 1080 in year 3. What is the duration of the bond in years?

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed.

Which one of the above statements is/are incorrect?

A maximum of _____% of the trade done by a fund house can be routed through a single broker

Investment classified under Held to Maturity category need not be _________.

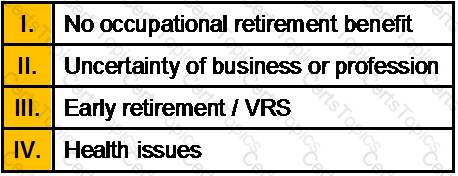

Which of the following is/are the key issues in retirement planning of self employed/ business class?

During last five years, Mr. Saxena owned securities that gave the following annual rate of return:

Which is the preferable security as per Geometric mean annual rate of return?

When bondholder pays more than par value to acquire bond, then

Which of the following statement is/are correct?

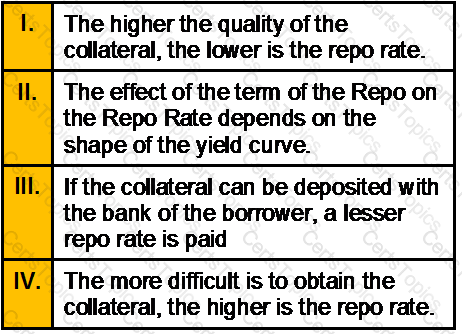

Which of the following statements in reference to REPO Rate is/are correct?

Which of the following statements are correct?

Income received in India in previous year is taxable in the hands of:

Mr. Kishan owns a factory producing some small spare parts.Under which policy he can get cover against the claim for paying damages and legal costs arising from any bodily injury or damage in the premises of his property ?

Which of the following statements is TRUE concerning zero coupon bonds?

You want to have Rs. 1,000,000 when you retire in 30 years. You expect to earn 12% compounded monthly over the entire 30-year period. How much extra money per month must you deposit if you choose to fund using an ordinary annuity technique rather than an annuity due technique ?

Any income chargeable under the based "Salaries" is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

An investor buys 200 units of a Mutual Fund scheme having a reinvestment option at Rs.10.5 on Jan 6, 2011. On June 30, 2011 scheme declares a dividend @10%. The ex-dividend N.A.V. was Rs.10.25. On March12, 2012 the fund N.A.V was Rs.12.25. Calculate CAGR?

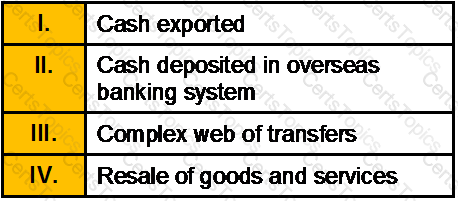

Which of the following transaction /transactions is/are an example of the Layering Stage of Money Laundering?

An increase in the market value of a company indicates:

Which one of the following statements is/are correct?

Binoy aged 30 years with a total income is 6,00,000 p.a pays Rs.25000 as LIC premium for a policy of 3 lakhs on his life. He also pays income tax of Rs. 30,000. His retirement age is 65. The self maintenance expenses are 1 lakh p.a. & rate of interest is 6% p.a. Calculate the total amount of insurance requirement under HLV method?

"To be sure to receive same day credit on a Saturday, NEFT instruction has to be given by _______."

Which of the following is an inferential data (i.e. data which may not be correctly obtained by simply asking a direct question)?

Calculate the total maturity amount payable in a policy of Rs. 4,00,000/-, if the term of the policy was 17 years and bonus was Rs. 52 per thousand per annum and a final bonus of Rs. 125/- per thousand was payable?

A portfolio consists of 50% of investment ‘R’ that earned 10%, 25% of investment ‘S’ that earned 6% and 25% of investment ‘T’ that earned 9%. Compute the weighted average return?

Which of the following statements is/ are correct?

Which of the following statements are true?

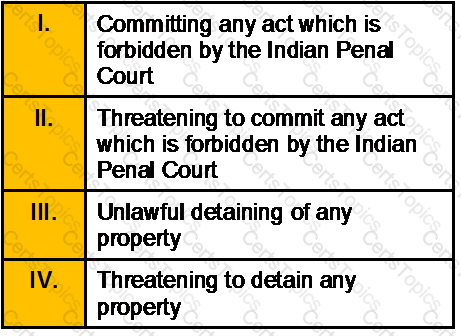

A contract is said to be caused by coercion when it is obtained by: