AACE International Related Exams

CCP Exam

CertsTopics stands out by offering high-quality, accurate, and up-to-date CCP exam dumps, questions and answers, and practice tests. We ensure smooth purchasing with instant access, allowing you to focus on your AACE Exam preparation.

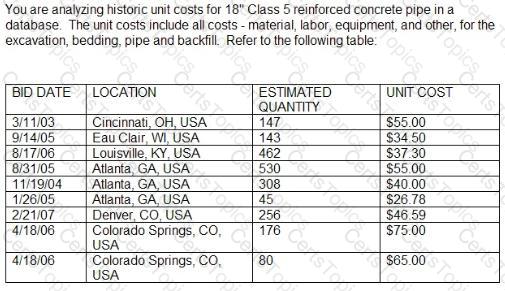

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the relative frequency of unit costs amounting to $55.00/unit?

Which of the following is NOT a type of float?

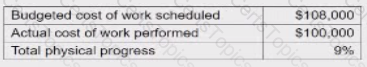

A small hole construction project has a baseline budget of $1,000,000. The project is scheduled to be constructed in 12 months. At the and of the first month, the project data is reported as below:

The following question requires your selection of Scenario 1.4.162 from the right side of your split screen, using the drop down menu, to reference during your response/choice of response.

The budgeted cost work performed is;