You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies.

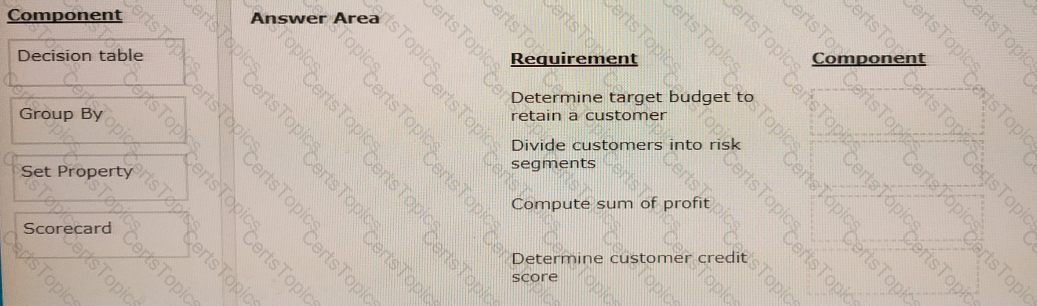

Select each component on the left and drag it to the correct requirement on the right.

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

To which types of decisions can Pega Customer Decision Hub™ be applied?

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub™. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

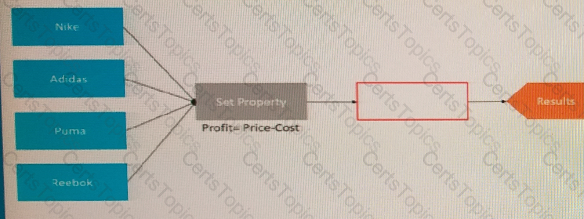

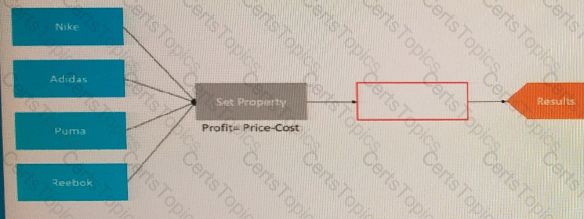

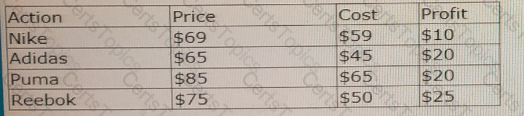

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

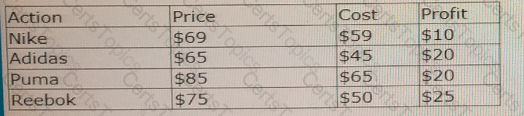

The details of the shoes are provided in the following table:

According to the decision strategy, what is the output of component in the blank space highlighted in red?

In an organization, customer actions are applicable to various business issues. What is the best way to organize them?

Reference module: Testing engagement policy conditions using audience simulation.

As a Decisioning Consultant, you are tasked with running an audience simulation to test the engagement policy conditions. Which of following statements is true when the simulation scope is Audience simulation with engagement policy and arbitration?

U+ Bank currently uses Next-Best-Action Designer to manage 1:1 customer engagement in the web channel. The bank would like to promote the same offers in email. Which two additional configurations are needed in Next-Best-Action Designer to promote the offers in email? (Choose Two)

Reference module: Testing engagement policy conditions using audience simulation

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

Reference module: Analyzing the effect of business changes using Pega Scenario Planner.

U+ Bank, a retail bank, completed an implementation to present Credit Card offers to customers on their self-service portals. You want to estimate the business value that the subsequent next-best-action run creates using the selected configuration. Which simulation do you run to get the required information?

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

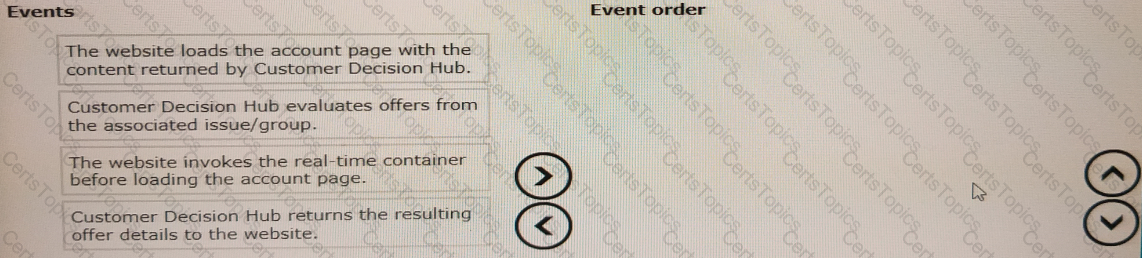

Place the events in the sequential order.

U+ Bank’s marketing department currently promotes various credit card offers by sending emails to qualified customers. Now the bank wants to limit the number of emails sent to their customers irrespective of past outcomes with a particular offer and customer. Which of the following options allows you to implement this business requirement?

U+ Bank has decided to nudge the Platinum Plus credit card to customers who visit their home page. Which arbitration factor do you configure to implement this requirement?

Reference module: Defining an action for outbound

Which statement is true about email treatments?

As a decisioning consultant, you advise the board on the business issues for which they must use the Next-Best-Action strategy.

Which three business issues do you recommend? (Choose Three)

Reference module: Leveraging predictive model.

U+, a retail bank, wants to show a retention offer to customers who are likely to leave the bank in the near future based on historical customer interaction data. Which type of model do you use to implement this requirement?

U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

Myco, a telco, currently promotes 24-month contracts with a free handset plus data plan, for example, MyPhone 11 and unlimited calls and data. The business structure has a sales issue/plans group that contains all actions, which are currently handsets.

Now, the company wants to introduce some new plans without handsets. So, the term handsets no longer applies to the new actions. At what level in the hierarchy can you rename the plans to reflect the new situation?

For a limited time period, a bank wants to avoid sending promotional emails related to credit card offers to a customer if they have already received one. Which rule do you need to define to implement this business requirement?

Aggregation components provide the ability to________________.

Reference module: Creating and understanding decision strategies.

MyCo, a mobile company, wants you to calculate the total revenue of three new actions offered in the first quarter. What do you configure to compute the total revenue?

U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

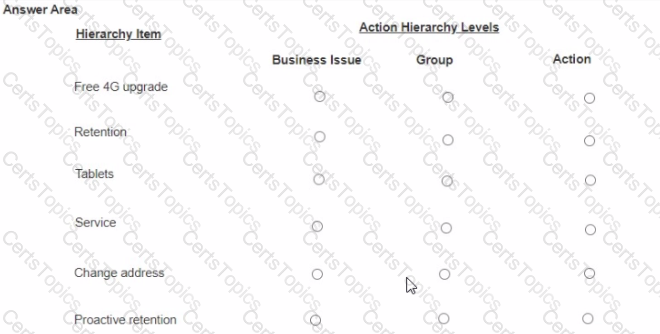

As a decisioning consultant you are setting up the action hierarchy for MyCo Select the correct action hierarchy level for each of the hierarchy items identified.

The following decision strategy outputs the most profitable shoe a retailer can sell. The profit is the selling Price of the shoe, minus the Cost to acquire the shoe.

The details of the shoes are provided in the following table:

What is the number of outputs that each component has?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

MyCo, a telecom company, introduced fiber optic service in the northern region of the country. They want to advertise this service on their website by using a banner and target the customers living in that area.

What do you need to configure in the Next-Best-Action Designer to implement this requirement?

A bank wants to add a contact policy that will suppress an action for 20 days if it was rejected twice in any channel in the last 30 days. How do you define the suppression rule for the contact policy?

A bank wants to present the Rewards Card offer on the top right of the customers’ account page when they log in. Select the placement type of the treatment design.

U+ Bank, a retail bank, offers the Standard card, the Rewards card and the Rewards Plus card to its customers. The bank wants to display the banner for the offer that each customer is most likely to click; therefore, their Arbitration uses Propensity from the AI models. If you are debugging the Next-Best-Action decision strategy, which strategy component will show you if the result of the Arbitration is correct?

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days

Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

To reference a customer property in a strategy, you need to prefix the property name with the keyword______________.

What is the name of the property that is automatically recomputed for each decision component?

U+ Bank realizes that customers have ignored a particular mortgage offer. As a result, the bank wants to offer the action 30% more frequently. Which arbitration factor do you configure to implement this requirement?

In a call-center application that receives Next-Best-Actions from Pega Customer Decision Hub, the customer service representative (CSR) is _________.

Reference module: Analyzing the effect of business changes using Pega Scenario Planner.

Myco, a telco, has recently implemented a project in which data plan offers are presented to qualified customers. Myco wants to understand the impact to revenue if the business introduces a new data plan offer. As a Decisioning Consultant, which simulation do you run to meet the requirement?

In a Decisioning Strategy, which decision component is required to enable access to the Customer properties like age, income, etc.?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer to the qualified customers on its website. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning consultant, you are now expected to make the remaining configurations in the Next-Best-Action Designer's Channel tab to enable the website to communicate with the Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you perform in the Next-Best-Action Designer's Channel tab? (Choose Two)

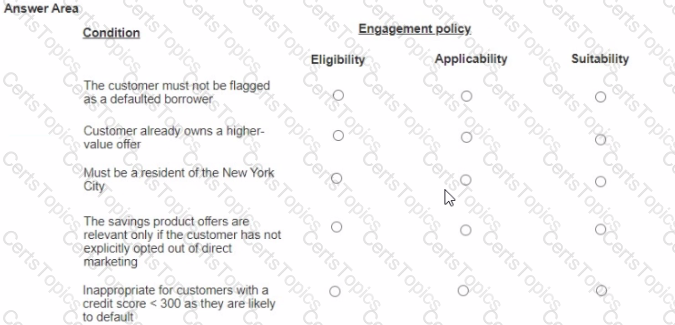

U+ Bank a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in lo the web self-service portal. The bank added engagement policy conditions to show the offers based on the banks requirements.

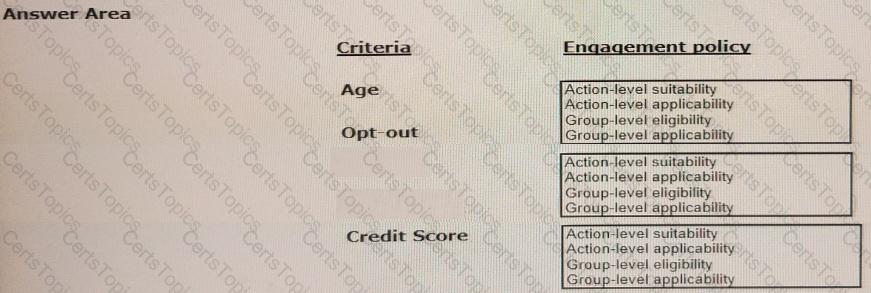

In the Answer Area select the correct engagement policy for each condition.

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

U+ Bank wants to leverage Pega Customer Decision Hub's Next Best Action capability to promote new offers to each customer who visits the website based on eligibility. For this requirement, the bank needs to define several complex eligibility criteria. As a decision consultant, how would you configure this requirement?

U+ Bank, a retail bank, wants to show home loan offers to customers who log in to their website. U+ Bank decides to use the Pega Customer Decision Hub™.

What information does the U+ Bank website receive in response to the real-time container request by Customer Decision Hub?

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

Reference module: Creating and understanding decision strategies

Enrichment decision components provide the ability to ________.

U+ Bank, a retail bank, does not want to annoy customers by offering them a mortgage refinance option if they have less than 5% to pay off on their loan, although it would be profitable for the bank. Which engagement policy condition best suits this requirement?

Reference module: Analyzing customer distribution using Pega Value Finder.

Myco, a telco, is working on implementing a project in which post-paid offers are presented to qualified customers. In the build stage of the ideation, the business wants to look for new opportunities to improve marketing. As a Decisioning Consultant, which simulation do you run to meet the requirement?

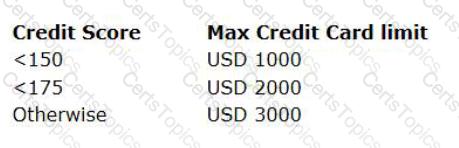

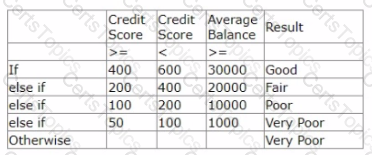

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

U+ Bank has decided to use the Pega Customer Decision Hub™ to recommend more relevant banner ads to its customers when they visit the personal portal.

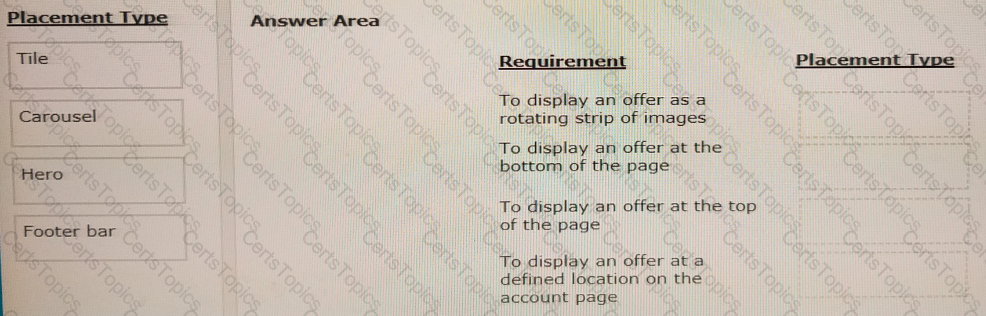

Select each placement type on the left and drag it to the correct requirement on the right.

U+ Bank, a retail bank, wants to begin promoting credit card offers via email to qualified customers. The business would like to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

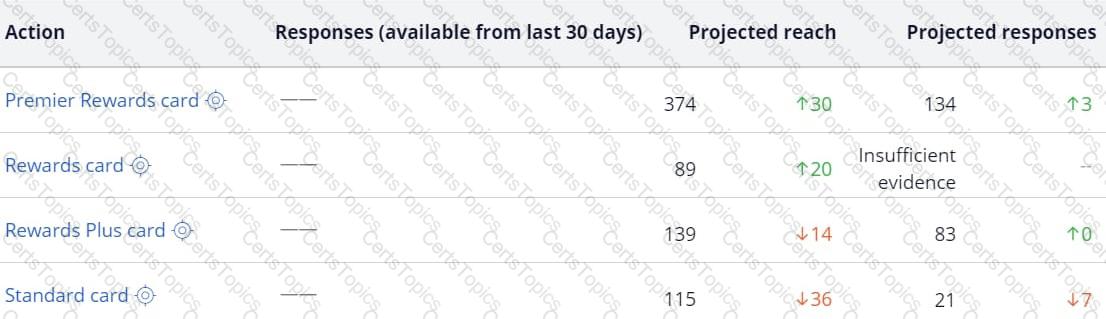

U + Bank, a retail bank, has applied business weight to their credit card offers to manually nudge the offers. The bank analyzes the effect of the change in Scenario Planner. The following image shows the projected reach and responses of the cards in the comparison mode. How many customers are likely to accept the Standard card?

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

In addition to the credit risk requirement, U+ Bank wants to offer credit cards to customers whose age is greater than 25.

As a best practice, which part of Customer Decision Hub do you access to ensure that credit cards are offered only to customers with age greater than 25?

A bank wants to leverage Pega Customer Decision Hub’s Next-Best-Action capability to promote new offers to each customer on their website. Which artifact do you need to configure to manage the communication between the Customer Decision Hub and external channels?

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website. The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer is presented on the website with the same offer five times in the last 14 days, do not show the same offer to that customer for the next 10 days.

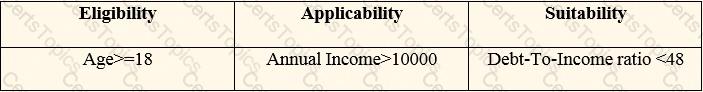

U+ Bank, a retail bank, is currently presenting a cashback offer on its website. Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer.

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45 As business user, what are the two tasks that you define to update the cashback offer? (Chose Two)

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach. The company is introducing a new data plan.

Which two channels can the company use to present the new data plan to a customer? (Choose Two)