The legal heir of the deceased who receives family pension is allowed a standard deduction from such family pension received to the extent of:

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed

Expenditure incurred in carrying out illegal business is—

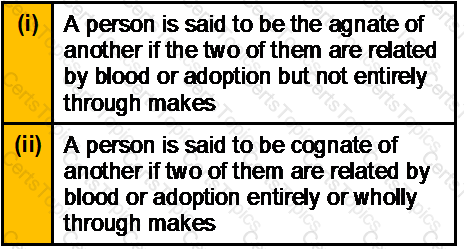

Which of the following statement(s) about Muslim Law is/are correct?

Mr. Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20,000 by his employers out of which he spends Rs.18,000 for shifting his family and personal effects. Which of the following is true?

In ____________ the parties have the right to withdraw from the contract as long as the parties do not leave the place of contract. In___________ the buyer could cancel the sale if the seller has sold the goods at price higher than the market price.

Mr. Pramod Jain (age 40 years) has life interest in a Trust property. The annual income from Trust property for last three years is as under:

The Trust has spent Rs. 5,000/- per year for collection of the income. The value of life interest of Re 1/- at the age of 40 is Rs. 10,093/-. The value of the property on the valuation date is Rs. 5 lakh. Find the value of life interest.

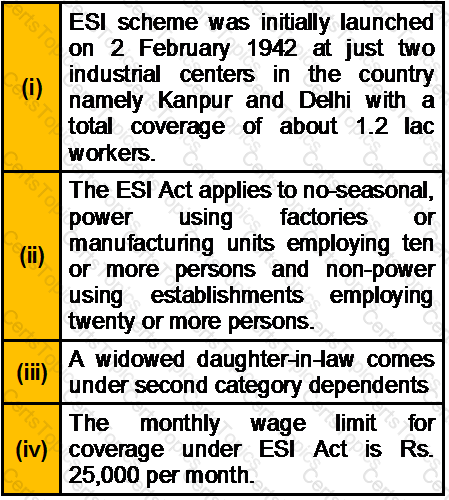

Which of the following statement(s) about Employee State Insurance Act is/are correct?

For claiming exemption u/s 54G, the assessed shall acquire the new asset within:

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

Choose the amount of final tax liability of Mr. Raj for the assessment year 2007-08:

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.

Which of the following statement(s) is/are incorrect?

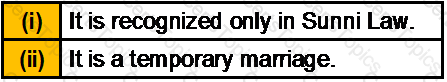

Which of the following statement(s) about Muta Marriage is/are correct?

Money-Laundering process has __________ stages.

Compulsory maintenance of account is required u/s 44AA of IT, if the gross receipt/ total sales exceed _______

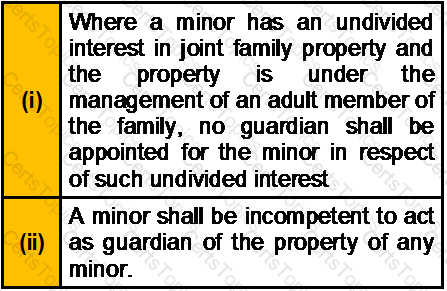

Which of the following statement(s) about Hindu Adoption and Maintenance Act, 1956 is/are correct?

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of:

Which of the following statement(s) about POA is/are correct?

Hire Purchase System was developed in ___________. Hire purchases are commonly used by businesses (including companies, partnerships and sole traders) in ________ to fund the purchase of cars, commercial vehicles and other business equipment.

Which of the following statement(s) is/are correct?

There are ________________ essential elements of a Lease.

The property of a female Hindu dying intestate shall devolve according to the rules set out in _________ of the Hindu Succession Act, 1956.

Which one of the above statement(s) is/are incorrect?

What is the full form of CLT?

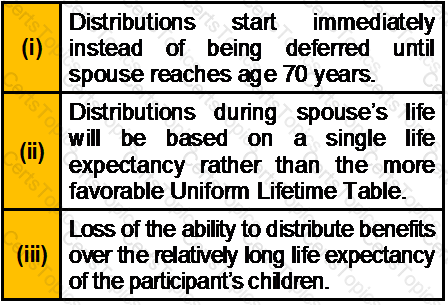

You are a Trust and Estate Planner. Mr. Keith is your client. He is 45 years old. He asks you that in case he wants to leave assets for the life benefit of his spouse, but ultimately have the funds pass to his children by a prior marriage he should create ______________________. He further asks you to explain disadvantages of such arrangement. You tell him that the disadvantages of the arrangement are ____________ of the given options.

Where a transfer of value is from a UK-domiciled spouse to a non-UK domiciled spouse, then the exempt transfer is limited to ____________

Mrs. Brown is a widow with four children. Her husband left his estate completely to her on his death. When Mrs. Brown dies, her estate on death includes:-

The funeral expenses of Mrs. Brown amount upto £1,900. Find out the amount of estate that would be distributable to each beneficiary.

Which one of the following statement(s) is/are correct?

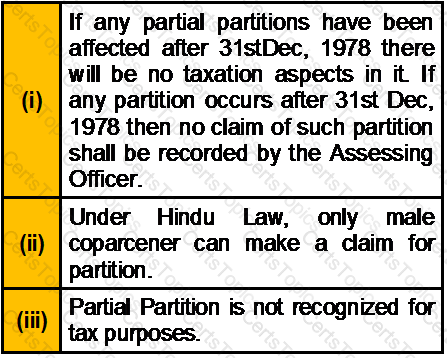

Which of the following statement(s) about partition of HUF is/are correct?

In case of __________ trust there is no Inheritance Tax if the settlor survives for _________ years.

__________________ is spoken rather than dictated or written.

With respect to the Income Tax structure in Singapore, the employment income is taxed at __________ or resident rate, whichever gives rise to a higher amount.

In case of Discretionary Discounted Gift Trust, the settlor has the right to receive annual capital payments upto ________ of the original capital. The trust is suitable for individuals who have a liability to ______________ and are happy to make substantial gifts.

A Hindu coparcenary consists of a common male ancestor and his linear descendants in the male line within _______ degrees. ___________ is the state in which HUF is not recognized.

Which of the following statement(s) about HUF Partition is/are correct?

Which of the following statement is true?

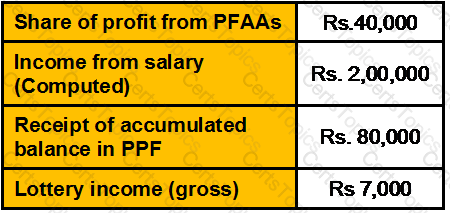

Exhibit:

As per Payment of Gratuity Act, Gratuity shall be payable to an employee after he has rendered continuous service for not less than __________

Which of the following statement(s) about Estate Planning is/are true?

Estate tax is also called ________

In context to Workmen’s Compensation Act, any claim for the compensation should be made within _________ of the occurrence of the accident or from the date of death.

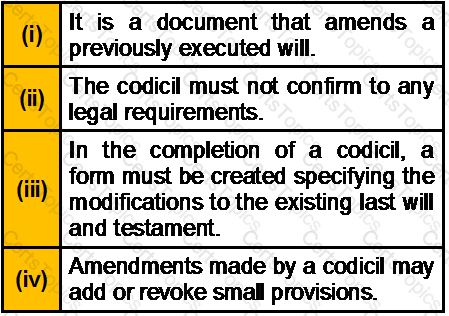

Which of the following statement(s) about codicil is/are correct?

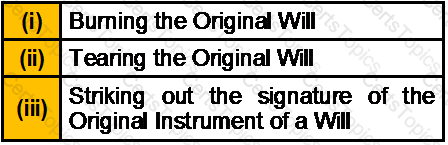

Which of the following is a way to Revoke a Will?

The goals of Estate Planning can be broadly divided into_______ categories.

___________ is appropriate for donors who want to see their charitable dollars at work during their lifetimes.

Which of the following statement(s) about Power of Attorney (POA) is/are correct?

More than_______ in wealth classifies the person as “Ultra HNI”

You have just started your Estate Planning firm. Your friend who is into Estate Planning since 5 years explains you that an Ideal Estate Planning Prospect is one who is aged ___ or over and are _______________.

If a soldier makes a Will in oral form, for what time will it be valid?

High Net Worth Individuals can dispose of their money in______ ways. From the standpoint of the wealth holder,__________ is the most important of all.

A will can be made by anyone above _____ years of age in India.

There are ____________ sources of Law.

Estate Tax in India is _______

The selling/ planning process has __________ steps.

Which of the following is/are essential(s) of a valid Charitable or Religious Trust?

The maximum limit of net wealth not chargeable to tax under provisions of the Wealth Tax Act,________ is Rs.___________ at present.

Which of the following is/are ancillary benefit(s) of Discretionary Family Trust?

A written instrument is necessary when a Trust is created in relation to an immovable property of the value of ______________ and upwards.

As per ______________ of the Indian Trust Act, the subject matter of a trust must be properly transferable to the beneficiary.

Which of the following statement(s) about Private Trust is/are correct?

To be qualified as a Simple Trust which of the following conditions has to be met?

Which of the following structure of Unborn Trust is not valid?

As per the Societies Registration Act, no society shall be dissolved unless ______________ of the members shall have expressed a wish for their votes delivered in person or by proxy, at a general meeting convened for the purpose.

______________ of the Transfer Property Act permits the transfer of property only to one or more living persons.

Which of the following statement(s) about “Oddball” trusts is/are correct?

______________ of Income Tax Act,1961 provides for the Registration of a Charitable Trust.

A person can create _________________ living trust/trusts while he is alive and the assets can be transferred to it/them as desired by the person.

The Indian Trusts Act, 1882 has _______________ Sections.

If a trust is partner in a firm, the maximum rate of tax applicable is

As per Section 164(1) a trust for the benefit of an unborn person is liable to income tax at maximum rate of Income Tax, currently_________.