A foreign company could raise capital in the United States using an:

Which of the following is a characteristic of giro systems used in countries in Europe?

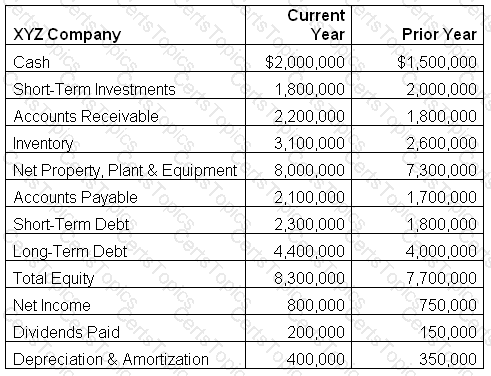

Use the financial statement for XYZ Company in the exhibit to answer this question.

What is the cash flow from operating activities for the current year?

Which of the following is subject to transaction exposure?