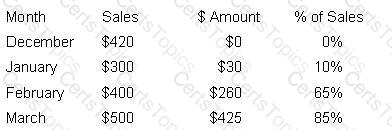

ACCOUNTS RECEIVABLE AT THE END OF MARCH

On the basis of the accounts receivable balance pattern above and April sales of $600, the cash flow forecast for April is:

A digital signature cannot be forged if:

Which method of financing would a company use to establish a wholly owned subsidiary to perform credit operations and obtain accounts receivable financing for the sale of products?

Company A has operated a Pension Plan since 1985. Despite a recent surge in asset values, the plan remains significantly underfunded. With the passage of the Pension Protection Act of 2006, Company A will be need to: