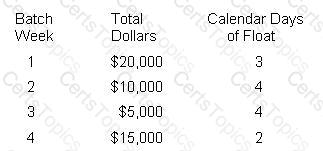

The lockbox receipt records for one 30-day month are provided below. The opportunity costs are 10%.

What is the annual cost of float rounded to the nearest dollar?

All of the following would encourage a company operating nationwide to develop multiple banking relationships EXCEPT:

A United States company must remit a dollar royalty payment to its Japanese subsidiary. Cash settlement of the payment would typically be made by which of the following?

ABC Company is a net borrower with a weighted average cost of capital of 11.5%. What kind of bank fee arrangement is it likely to prefer?