A UK based company is considering an investment of GB£1,000,000 in a project in the USA. It is anticipated that the following cash flows will arise from this project.

The cash flows will be either US$400,000 with a probability of 40% or US$700,000 with a probability of 60% for each of the next three years; remitted to the UK at the end of each year.

Currently GB£1.00 is worth US$1.30.

The expected inflation rates in the two countries over the next four years are 2% in the UK and 4% in the US.

Applying the Purchasing Power Parity Theory, which of the following represents the expected net present value of the project in GP£ (to the nearest whole pound)?

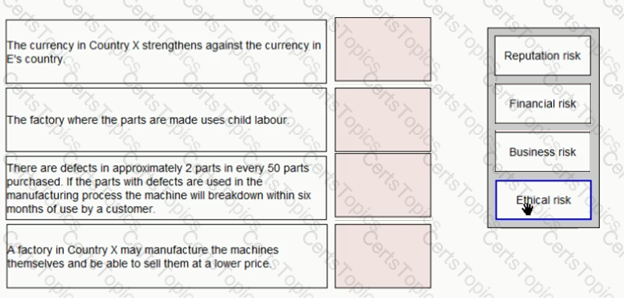

E purchases parts for one of the machines it manufactures from Country X Place the risk classification next to the risk it relates to:

Which of the following is the major advantage of Cloud storage for an enterprise?

There are many method for appraising capital projects.

Select ALL correct statements.