SDF has a variable rate loan of $100 million on which it is paying interest of LIBOR + 2%.

SDF entered into a swap with CV bank to convert this to a fixed rate 7% loan. CV bank charges an annual commission of 0.3% for making this arrangement.

Calculate the net payment from SDF to CV bank at the end of the first year if LIBOR was 3% throughout the year.

Give your answer in $ million, to one decimal place.

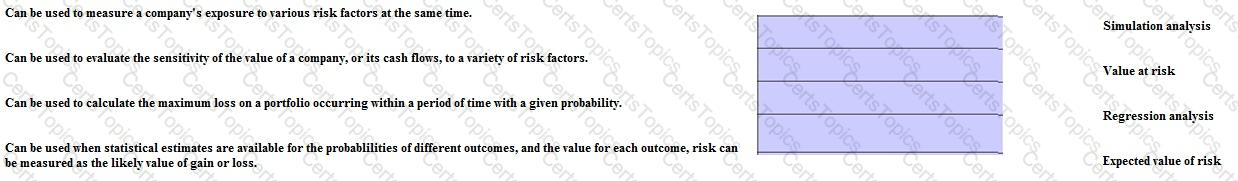

Match the descriptions shown in the boxes below with the method of quantifying risk exposure it best describes.