APA Related Exams

FPC-Remote Exam

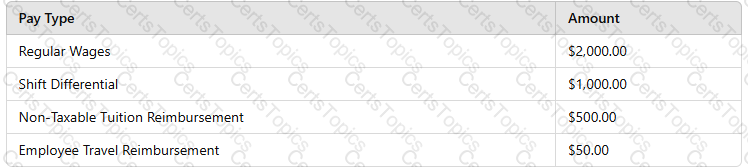

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

A mechanism which facilitates local tax withholding for an employee who is working abroad, but remains on the home country’s payroll system and is paid under a tax equalization plan, is called a(n):

An employee hired on July 1, 2021, terminates employment on September 30, 2022. What is the earliest date the employer may dispose of the Form I-9?