An Adjuster at Succeed Insurance is handling a personal auto claim for an insured who hit a tree after swerving to avoid a child who ran into the road.

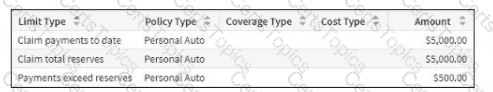

The Adjuster has this Authority Limit Profile:

The Adjuster creates a collision exposure and sets the initial reserves so that payments can be made to the insured for repairs to the damaged vehicle. No payments have been created yet.

The current financials for the claim are as follows:

Which two financial transactions will not require approval given that each option is the only transaction change rather than a cumulative change? (Choose two.)

Which set of three objects is required to create a liability exposure?

Succeed Insurance is expanding into California, Texas, and Arizona which have large Spanish-speaking customer bases. Currently language is not considered in assignment. Succeed wants the ability to assign claims to appropriate bilingual Adjusters. Succeed also needs the ability to identify the preferred language of the customers.

The company is planning to implement a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the existing user interface (UI) to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to enhance the operational efficiency and expediency of claims processing in its region.

Which two guiding principles apply to this implementation? (Choose two.)

A sales executive and business traveler has a full coverage auto policy through his insurance company. The executive lives in Detroit, Michigan and often drives across the border to visit client offices in Canada.

While driving in downtown Toronto, the executive's car was hit by a truck coming the wrong way. He called his insurance company to report a claim for this accident. However, the Customer Service Representative (CSR) cannot confirm there is an active policy on file.

How should this claim be handled?