AIWMI Related Exams

CCRA-L2 Exam

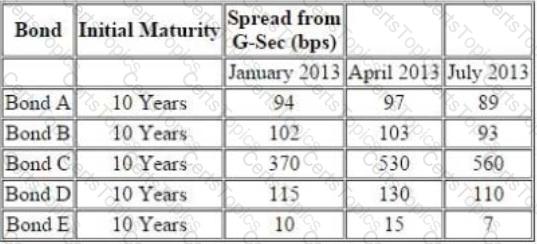

The following information pertains to bonds:

Further following information is available about a particular bond ‘Bond F’

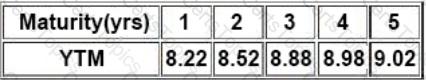

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the GSec has not changed?

Basket Default swaps could be

Project 1: Company X has a sugar mill at Philadelphia and is replicating same at Toronto.

Project 2: Company Y has a sugar mill at Philadelphia and is increasing capacity from 100000 MT to 140000 MT per annum.

What type of projects are Project 1 and Project 2?