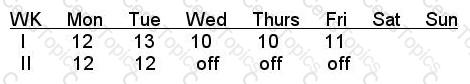

Under FLSA, how many hours would be paid a time and one half for the following biweekly period, assuming that the employee is a health care professional paid under the special FLSA rules?

The employer must withhold FICA and federal income taxes, and pay FUTA tax, when the employee's tips exceed what amount?

Which of the following would NOT be defined as a tax-deferred benefit?

Brenda receives a prize as a winner of a sales contest. The prize, which is paid from her sales manager's petty cash account, is $25. Which of the following best represents the impact on her taxable wages?